In international trade, correctly filling in business invoices is one of the key steps to ensure that transactions go smoothly. Business invoices are not only proof of the sale of goods, but also an important basis for settlement, customs declaration and calculation of customs duties between buyers and sellers. Form invoices, also known as pre-development tickets, are mainly used to confirm prices and product information at the beginning of transactions. This article will introduce the completion guidelines for foreign trade business invoices and the differences between them and form invoices.

Difference Between Foreign Trade Commercial Invoices and Formal Invoices

Foreign trade invoices:

1 The formality:A foreign trade trade invoice is a formal trade settlement document, usually issued after the shipment of goods.

The legal status:As proof of formal transactions between the buyer and seller, it has legal effect on customs declarations, settlements, and taxes.

The contents are detailed:Detailed information such as the name, specification, quantity, single price and total price of the goods must be consistent with the credit certificate and contract provisions.

Form of invoice:

The informality:It is usually used in the early stages of the transaction as a preliminary confirmation of price and product information.

The Contract Functions:In some cases, it can be used as a contract for small transactions.

Simplification of content:Mainly includes the information of the buyer and seller, the expected price, the description of the goods and other basic information.

Role of Foreign Trade Commercial Invoices

Purposes for Importers:It makes it easier for importers to understand goods information in a timely manner, for accounting, customs reporting, verification of taxes, etc.

For customs purposes:As a basis for customs tax checks, it contributes to the rapid release of goods.

Commercial settlement of:In the absence of exchange bills, invoices can be used as a direct basis for payment.

Proof of claim:In case of loss or risk of goods, commercial invoices are important insurance claims documents.

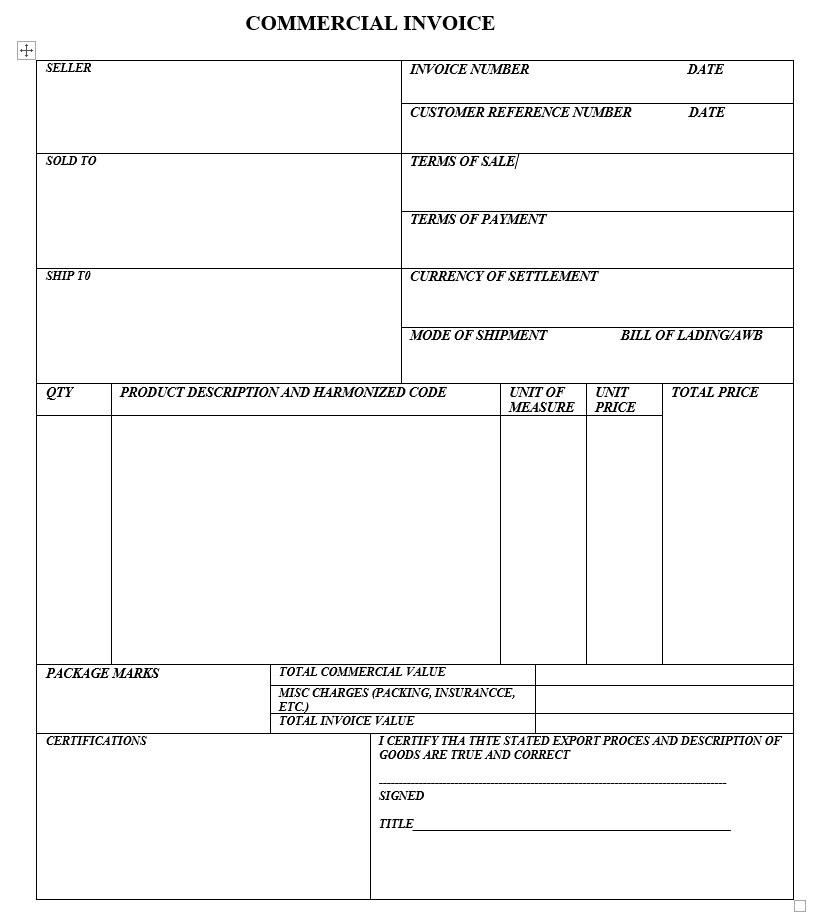

Filling out foreign trade trade invoices

Information of the Seller:Complete the name and address of the seller to ensure consistency with the credit card and contract.

Information for buyers:The details of filling in the buyer's name and address, if there is a credit card requirement, must be strictly observed.

Number of invoice:To prepare and maintain consistency between trade documents.

Date of invoice:Choose after the opening date and before the shipping date.

Credit card information:If applicable, the credit card number and the opening date must be completed accurately.

Contract information :Clearly indicate the number of the contract and the date of signing, and maintain consistency with credit certificates and other documents.

The shipment information:Including the place of departure, destination, means of transportation and head, must be consistent with the ticket and other transportation documents.

Description of goods:The detailed description of the name, specification, quantity, single price and total price of the goods must be consistent with the contract and credit certificate requirements.

Fulfilling foreign trade business invoices accurately and flawlessly is crucial to ensuring that international trade goes smoothly. Understanding the difference between foreign trade business invoices and formal invoices can help trade parties handle various documents in the transaction process more clearly. Following the correct completion guidelines can not only avoid unnecessary delays and additional costs, but also safeguard the rights and interests of both parties and ensure the successful completion of the transaction.

Follow customer service WeChat

Follow customer service WeChat